Does the Nintendo Switch eShop Charge Tax?

Last updated

So, you’re scrolling through the Nintendo Switch eShop, eyeing that game you’ve been dying to play. Suddenly, a thought pops up: “Does the Nintendo Switch eShop charge tax on my purchases?” Let’s dive into this question and clear up any confusion.

When you’re about to hit that ‘buy’ button on the Nintendo Switch eShop, it’s normal to wonder about taxes. After all, no one likes surprise charges!

Indeed, the Nintendo Switch eShop Does Charge Tax

Yes, the Nintendo Switch eShop does apply tax to your purchases. However, the tax rate can differ based on where you live. Since tax laws vary from place to place, the amount of tax you pay depends on your local tax rates.

The reason behind this is quite simple. Just like when you shop in a physical store, online stores, including the Nintendo eShop, must follow the tax laws of each country or state. So, when you’re buying a game or any digital content, your location impacts the tax you’re charged.

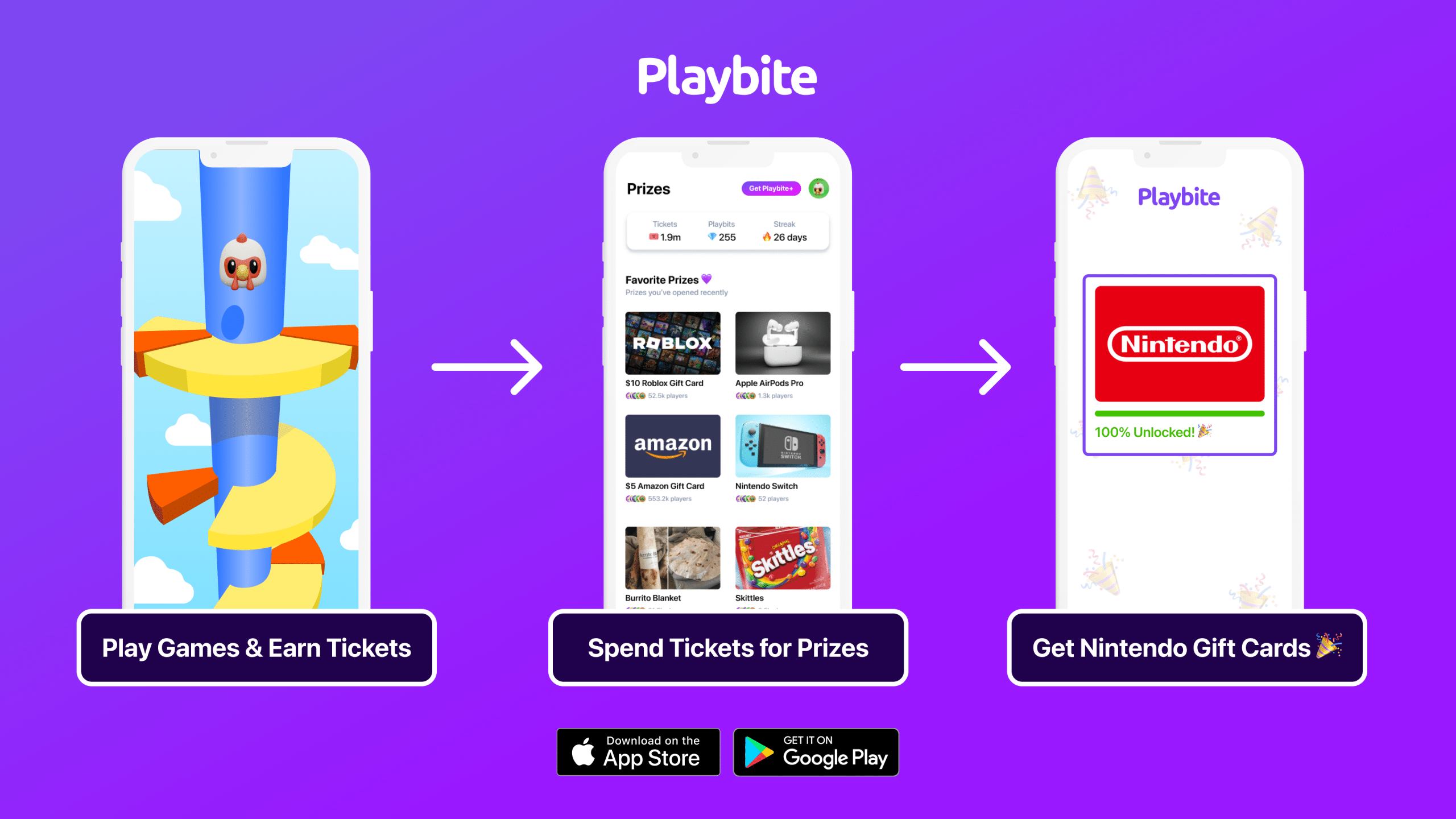

Turn Your eShop Purchases Into Playtime on Playbite

Now that we’ve cleared up the tax question, how about turning those purchases into more fun? With Playbite, an app where you can earn rewards for playing casual mobile games, you can actually get Nintendo eShop Gift Cards just by having a blast! Imagine playing fun games and earning rewards that you can use to buy even more games on the Nintendo Switch eShop.

By downloading the Playbite app, not only do you get a shot at winning eShop Gift Cards, but you also join a community of gamers just like you. It’s a win-win: you enjoy playing games and potentially snag some cool Nintendo goodies in the process. So why wait? Dive into the world of Playbite and let your gaming earn you more games!

In case you’re wondering: Playbite simply makes money from (not super annoying) ads and (totally optional) in-app purchases. It then uses that money to reward players with really cool prizes!

Join Playbite today!

The brands referenced on this page are not sponsors of the rewards or otherwise affiliated with this company. The logos and other identifying marks attached are trademarks of and owned by each represented company and/or its affiliates. Please visit each company's website for additional terms and conditions.