How Much Tax Does Nintendo eShop Charge?

Last updated

Ever wondered how much tax you need to pay when buying games from the Nintendo eShop? Let’s clear that up in a fun way!

Today, we’re diving into the world of gaming to answer a burning question: How much tax does the Nintendo eShop charge?

Short Answer: It Depends on Where You Live

When you snag your favorite games from the Nintendo eShop, the tax you pay depends on your location. Yes, it’s all about where your gaming cave is!

Because taxes vary from place to place, Nintendo checks your account’s registered address to decide the tax rate. This means your buddy in another state might pay a bit more or less in tax for the same game. Crazy, right?

Why Your Location Matters for Nintendo eShop Taxes

Your state or country has its own tax laws, and that’s what Nintendo follows when you buy a game. So, the final price might include a bit extra for tax, depending on your local tax rate.

Remember, Nintendo wants to keep things fair and legal by following local tax rules. So, if you’re wondering why your game’s price looks a bit different at checkout, now you know it’s because of the tax!

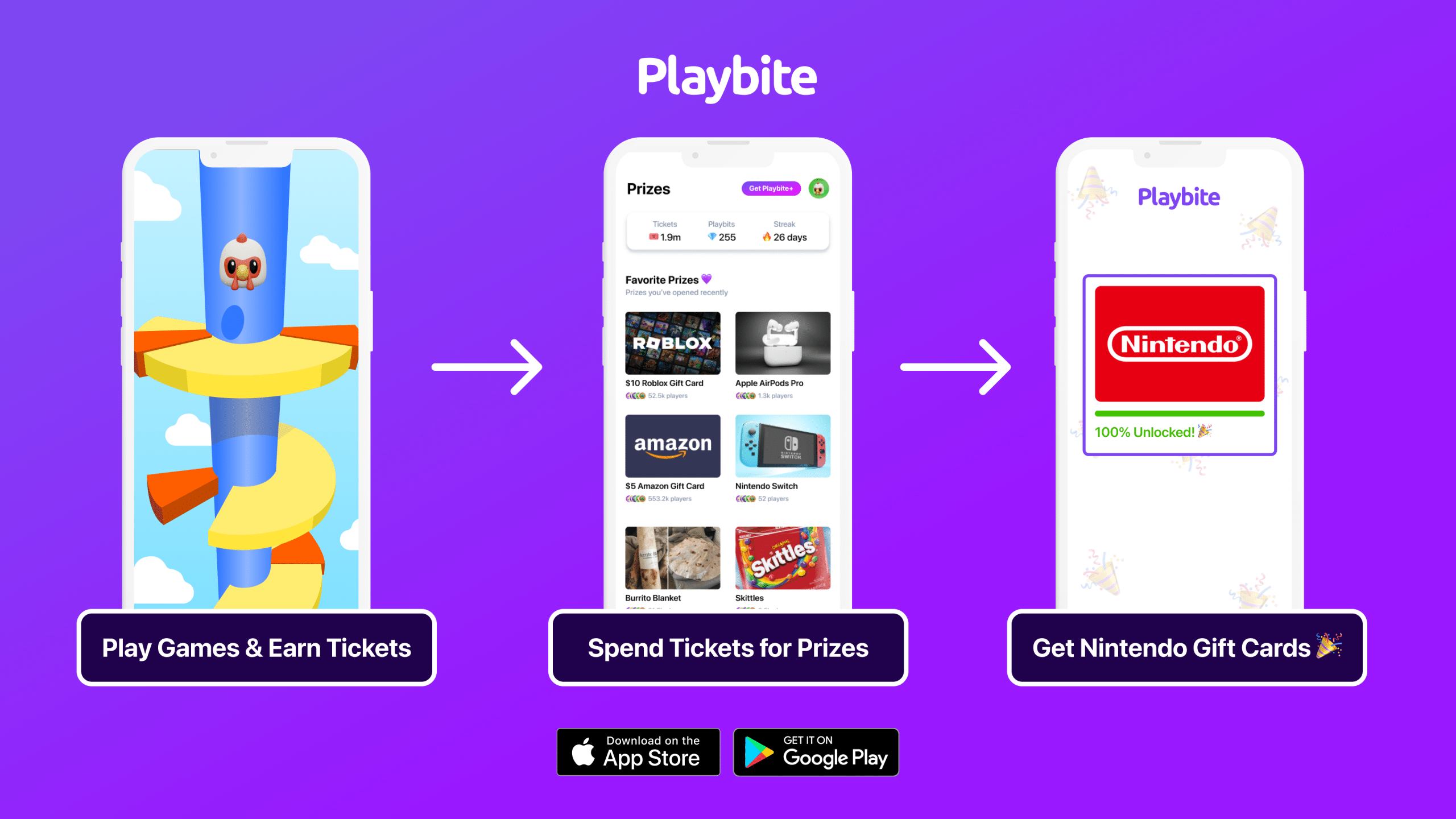

Win Nintendo eShop Gift Cards on Playbite

Now, here’s the fun part: You can win Nintendo eShop Gift Cards by playing games on Playbite! Imagine getting your next game without worrying about the tax because you got it with a gift card you won just by having fun.

With Playbite, not only do you enjoy loads of exciting games, but you also earn points that can turn into awesome rewards like Nintendo eShop Gift Cards. So, why wait? Download Playbite now and start earning towards your next Nintendo adventure!

In case you’re wondering: Playbite simply makes money from (not super annoying) ads and (totally optional) in-app purchases. It then uses that money to reward players with really cool prizes!

Join Playbite today!

The brands referenced on this page are not sponsors of the rewards or otherwise affiliated with this company. The logos and other identifying marks attached are trademarks of and owned by each represented company and/or its affiliates. Please visit each company's website for additional terms and conditions.